One MobiKwik Systems Limited (MobiKwik) is an online payment system company. MobiKwik is into the major business of Buy Now Pay Later (BNPL), Payment Gateway, and P2P Payment systems like MobiKwik Wallet, UPI, etc. BNPL provides accessible and affordable credit to its customers. MobiKwik filed official papers for an initial public offer (IPO) on 12 July 2021.

MobiKwik filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI), here are the key factors:

- The company wants to raise Rs 1,900 Crore.

- Offers a fresh issue of Rs 1,500 Cr. & offer for sale of Rs 400 Cr.

- Shareholder’s offer: Bipin Preet Singh(Rs 111.33Cr.), Upasana Rupkrishan Taku(Rs 78.81), American Express Travel Related Services Co Inc (Rs9.98Cr.), Bajaj Finance Limited(Rs 68.98Cr.), Cisco Systems (USA) Pvt Ltd(Rs 11.48 Cr.), Sequoia Capital India Investment Holdings(Rs 94.98Cr.), and Tree Line Asia Master Fund (Singapore) Pvt Ltd (Rs 24.41Cr).

- BNP Paribas, Credit Suisse Securities (India) Private Limited, and ICICI Securities Limited are appointed as Book Running Lead Managers.

MobiKwik IPO Details

| Company | One MobiKwik Systems Limited (MobiKwik) |

| Founder | Bipin Preet Singh, Upasana Taku |

| Sector | Financial technology |

| IPO Opening Date | To be announced soon |

| IPO Closing Date | To be announced soon |

| Issue Size | Rs 1,900 Cr. (Fresh Issue – Rs 1,500 Cr.) (OFS – Rs 400 Cr.) |

| Employee Reservation | – |

| Face Value | ₹ 2 per share |

| Price Band | To be announced soon |

| Lot Size | To be announced soon |

| Exchange | NSE, BSE |

| BRLMs | BNP Paribas, Credit Suisse Securities (India) Private Limited, and ICICI Securities Limited |

| Incorporation | April 2009 |

| Website | www.mobikwik.com |

MobiKwik IPO Listing Timeline

| Events | Date |

| IPO Opening Date | – |

| IPO Closing Date | – |

| Basis of Allotment | – |

| Initiation of Refunds | – |

| Credit Shares to Demat A/C | – |

| IPO Listing Date | – |

IPO Subscription Category

| Category | Subscription (times) |

| Non-Institutional Investor | – |

| Qualified institutional buyer | – |

| Retail | – |

| Employee | – |

| Total | – |

IPO Documents

| DRHP |

| RHP |

Strengths

- MobiKwik has 10.13 Cr. user base data & 4.15 Cr. KYC completed users.

- Cross-sell to a large customer base: insurance, loan, and other wealth products.

- The company has a network of 3.4 million merchant partners.

- Cross-sell to a large merchant network: Payment gateway services.

- Buy Now Pay Later(BNPL) products- ZIP and ZIP EMI.

- ZIP provides 15 days of interest-free credit in a signal tap.

- MobiKwik Merchant Acquisition in every segment like- e-commerce, physical retail, bill payments, etc.

- The economy going to be cashless so this is a future opportunity for MobiKwik.

Risks

- Data security from cyber threats like- malware, computer viruses, and other cyberattacks.

- Credit risk in ZIP-free credit & BNPL service.

- The company generates continuous losses.

- Negative cash flow in recent years.

- Business depends on online platforms.

- High level of competition in the fintech industry and it takes a lot of investment to survive.

MobiKwik Financial Reports

| FY- Years | Revenue | Net Loss | Adj. EBITDA |

| 18-19 | 160 | -147 | -138 |

| 19-20 | 369 | -99 | -56 |

| 20-21 | 302 | -111 | -98 |

| FY– Years | Cash Flow (CR.) | EPS (Rs) | Adj. EBITDA margin |

| 18-19 | -17.98 | -31.01 | -86.59% |

| 19-20 | -46.27 | -20.45 | -15.28% |

| 20-21 | 2.28 | -22.18 | -32.65% |

| FY–Years | Total Assets | Liabilities (Borrowings) | Share Capital |

| 18-19 | 335.08 | 73.47 | 1.05 |

| 19-20 | 337.93 | 63.73 | 1.05 |

| 20-21 | 423.14 | 58.04 | 1.05 |

FAQs

MobiKwik IPO listing date is _

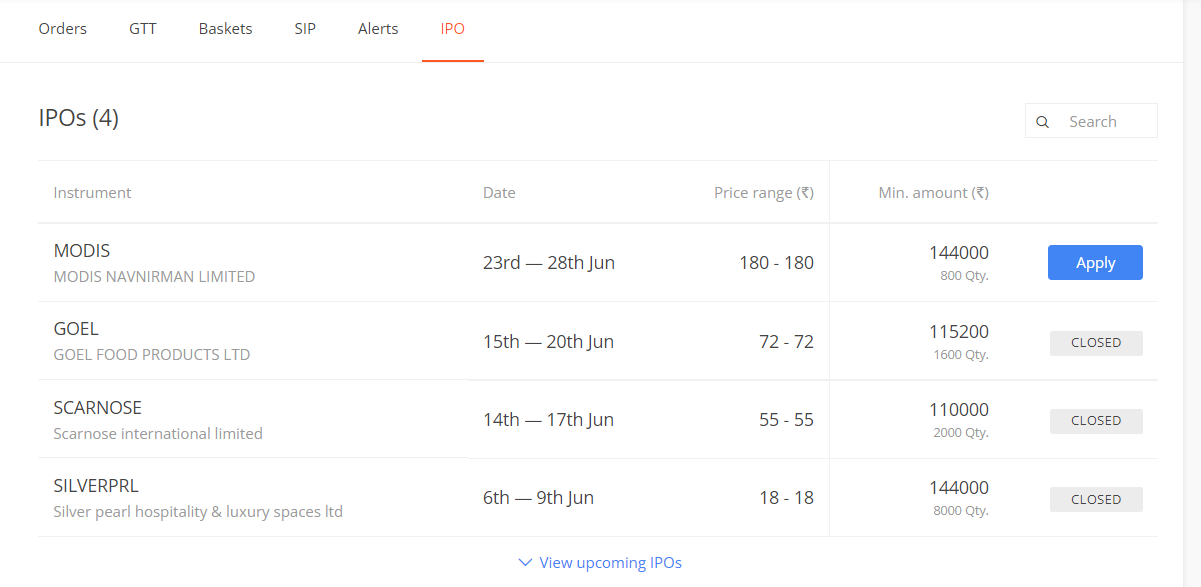

1. First, open a Demat account with Zerodha

2. Get Username & Password and Login.

3. Now go to the Order section and click on IPOs

4. You can see the currently active IPOs.

5. Now click on the apply button as an individual investor.

6. Enter your UPI id, Bid quantity, and Price amount.

7. After all that click on the Submit to Apply for IPO.

As per reports, MobiKwik IPO will launch before November 2022.

The minimum lot size for MobiKwik IPO is _.

MobiKwik IPO Issue size is Rs 1,900 Cr., in which Rs 1,500 Cr. is a fresh issue and Rs 400 Cr. is an offer for sale.

MobiKwik IPO will Launch before Nov. 2022 and after listening you get the share price.

Bipin Preet Singh and Upasana Taku is the owner of the MobiKwik.

0 Comments