Allied Blenders & Distillers filed official papers for an Initial Public Offer (IPO) on 28 June 2022. Allied Blenders & Distillers (ABD) is the largest Indian spirits company that owns many famous whiskey & Rum brands like – Officer’s Choice Black, Jolly Roger Rum, etc. As per the prospectus, the company sells products to 22+ countries. ABD has all over India distribution chains & 30 bottling units with third-party bottling facilities across India.

Here are the Key factors of Allied Blenders & Distillers (DRHP) Draft Red Herring Prospectus:

- The company wants to raise Rs 2,000 Crore.

- Offers a fresh issue of Rs 1,000 Cr. & offer for sale of Rs 1,000 Cr.

- Shareholder’s offer: Bina Kishore Chhabria (Rs 500 Cr.), Resham Chhabria Jeetendra Hemdev (Rs 250 Cr.), and Neesha Kishore Chhabria (Rs 250 Cr.).

- Axis Capital Limited, ICICI Securities Limited, JM Financial Limited, Kotak Mahindra Capital Company Limited, and Equirus Capital Private Limited were appointed as Book Running Lead Managers.

Allied Blenders & Distillers IPO Details

| Company | Allied Blenders & Distillers Pvt. Ltd. |

| Founder | Kishore Chhabria |

| Sector | Beverage Industry |

| IPO Opening Date | To be announced soon |

| IPO Closing Date | To be announced soon |

| Issue Size | Rs 2,000 Cr. (Fresh Issue – Rs 1,000 Cr.) (OFS – Rs 1,000 Cr.) |

| Employee Reservation | – |

| Face Value | ₹ 2 per share |

| Price Band | To be announced soon |

| Lot Size | To be announced soon |

| Exchange | NSE, BSE |

| BRLMs | Axis Capital Limited, ICICI Securities Limited, JM Financial Limited, Kotak Mahindra Capital Company Limited, and Equirus Capital Private Limited |

| Incorporation | Oct. 2008 |

| Website | www.abdindia.com |

Allied Blenders & Distillers IPO Listing Timeline

| Events | Date |

| IPO Opening Date | – |

| IPO Closing Date | – |

| Basis of Allotment | – |

| Initiation of Refunds | – |

| Credit Shares to Demat A/C | – |

| IPO Listing Date | – |

IPO Subscription Category

| Category | Subscription (times) |

| Non-Institutional Investor | – |

| Qualified institutional buyer | – |

| Retail | – |

| Employee | – |

| Total | – |

Strengths

- ABD Is the largest Indian-owned Indian-made foreign liquor (IMFL) company in India with a diversified product portfolio.

- All-India distribution network with the ability to expand.

- The Company generates positive cash flow from its operation.

- ABD is a leading exporter of IMFL, in terms of annual sales volumes The company exports its products to 22+ countries internationally, including countries in North and South America, Africa, Asia, and Europe.

- The company has Strategically located, large-scale, and advanced manufacturing facilities with research & development centers.

- ABD has comprehensive insurance to protect the company against various hazards.

- The company continues to focus on improving operational efficiencies.

Risks

- ABD depends only on whisky products, and a reduction in sales of these products could harm The business.

- The company depends on West Bengal, Telangana, and Uttar Pradesh for the sale of products. These states cover more than 50% of total sales.

- COVID-19 pandemic impact on business & operations, and financial condition.

- The amount of Rs 111.46 Cr Tax proceedings against the company.

- Restrictions on advertising alcoholic products in India may affect business indirectly.

- The company’s operations are regulated by Central and State regulations. Any adverse changes in the regulation may affect business activities.

Allied Blenders & Distillers Financial Reports

| Years | Revenue | Profit After Tax | Adjusted EBITDA |

| FY18-19 | 8,934 | 15.20 | 316 |

| FY19-20 | 8,119 | 12.80 | 250 |

| FY20-21 | 6,378 | 2.51 | 213 |

| FY21-22 (for 9 months) | 5,445 | 3.30 | 158 |

| Years | Cash Flow (Cr.) | EPS | EBITDA Margin |

| FY18-19 | 18.94 | 0.65 | 10.33% |

| FY19-20 | 72.28 | 0.53 | 8.35% |

| FY20-21 | 43.49 | 0.10 | 9.07% |

| FY21-22 (for 9 months) | 17.04 | 0.14 | 8.15% |

| Years | Total Assets | Liabilities (Borrowings) | Share Capital |

| FY18-19 | 2,631 | 1,335 | 47.11 |

| FY19-20 | 2,400 | 1,032 | 47.11 |

| FY20-21 | 2,298 | 954 | 47.11 |

| FY21-22 (for 9 months) | 2,460 | 926 | 47.11 |

FAQs

Allied Blenders & Distillers IPO will be open from ___ to ___

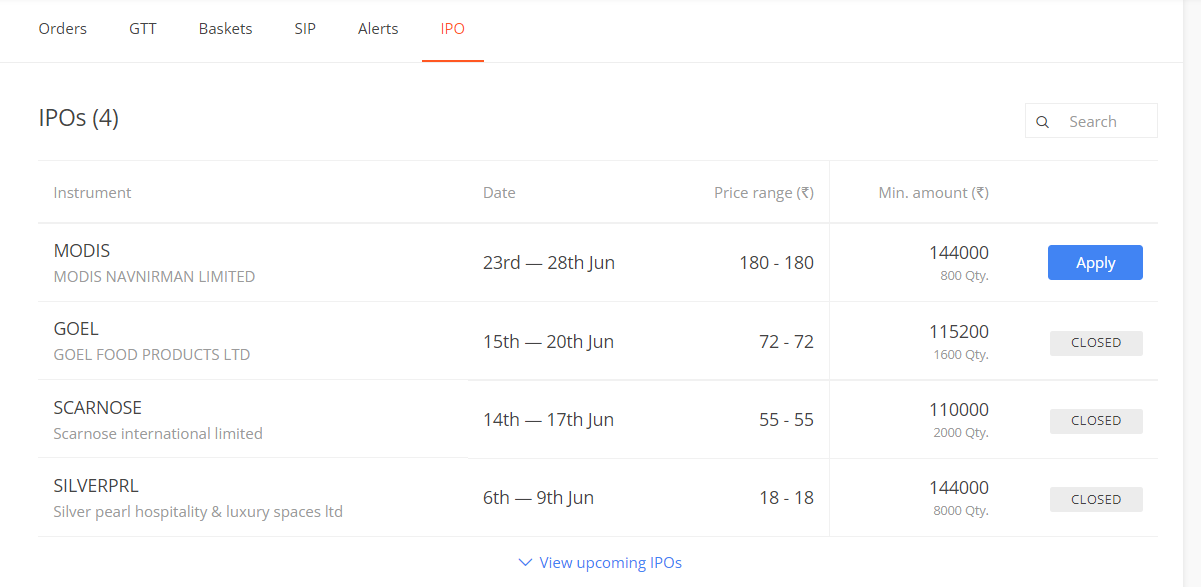

1. First, open a Demat account with Zerodha

2. Get Username & Password and Login.

3. Now go to the Order section and click on IPOs

4. You can see the currently active IPOs.

5. Now click on the apply button as an individual investor.

6. Enter your UPI id, Bid quantity, and Price amount.

7. After all that click on the Submit to Apply for IPO.

Allied Blenders & Distillers (ABD) IPO lot size is _

Allied Blenders & Distillers (ABD) IPO Issue size is Rs 2000 Cr., in which Rs 1,000 Cr. is a fresh issue and Rs 1,000 Cr. is an offer for sale.

The minimum investment is 12,500 to 15,000 amount as for 1 lot in Allied Blenders & Distillers IPO.

“Kishore Chhabria” is the owner of Allied Blenders and Distillers(ABD).

Allied Blenders and Distillers IPO will be open From _ and close on _.

0 Comments